International Trade Financing Services Platform

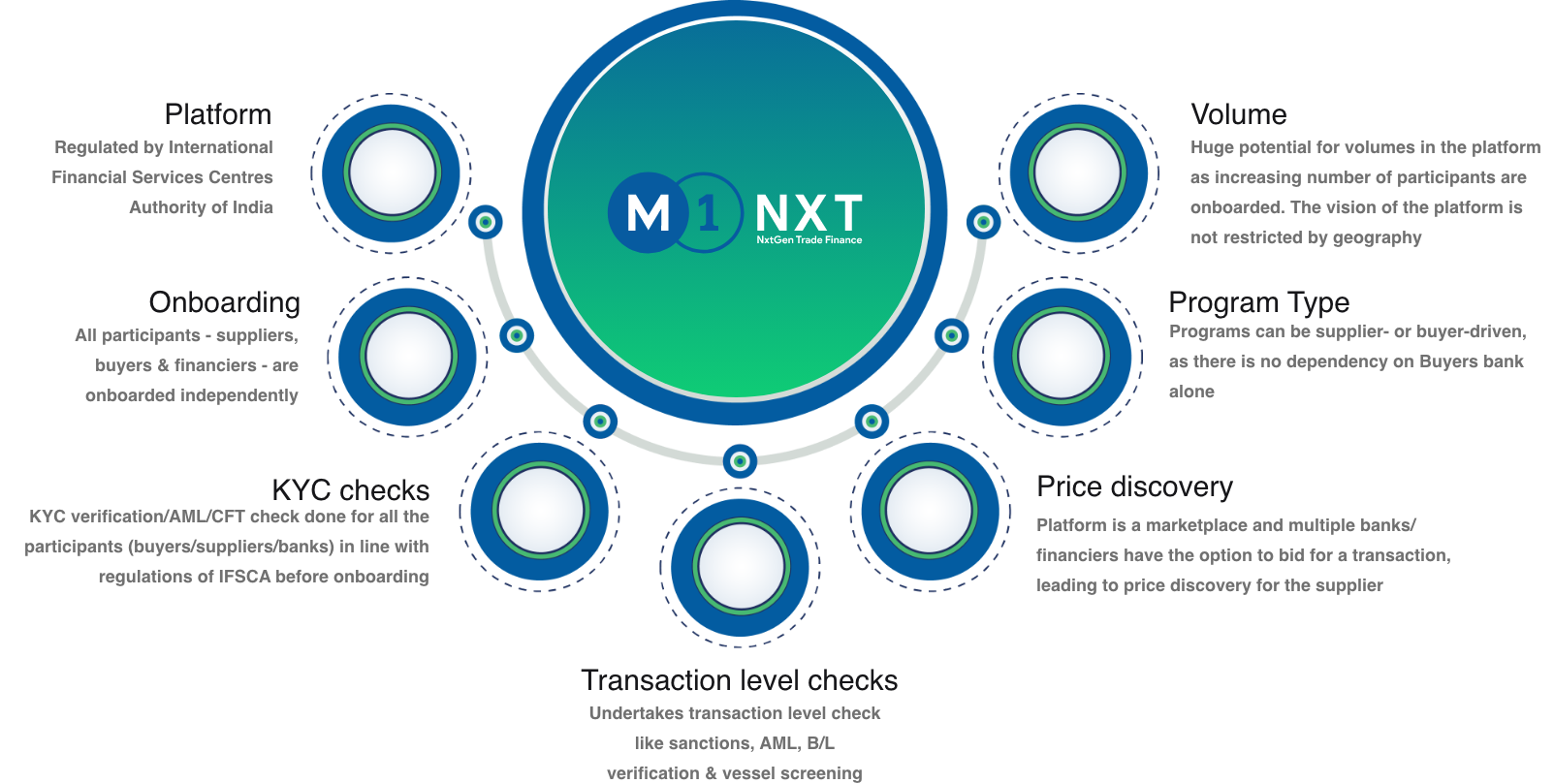

M1 NXT, a next-generation leading provider of working capital solutions, is a future-ready, seamless, competitive, secure, and paperless online platform. It is a digital marketplace for international factoring products, with approval received for conducting sandbox testing under the regulator’s supervision.

Mynd IFSC Pvt Ltd is the operator of M1 NXT platform

Specializes in cross border transactions & finances trade globally for sales/purchase made on open account

Approved by International Financial Services Centres Authority (IFSCA) to setup the International Trade Financing Services Platform in the GIFT City

Unique Platform in the Global Trade Landscape with key differential features

Easy, fast finance of receivables at competitive rates

Without recourse finance

Off balance sheet finance

Minimum and simple documentation

Risk on Buyers

Receipt of funds within 48 hrs from acceptance of DOA

Opportunity to build quality asset portfolio in international space

Reduced operational cost along with improved reach to build clientele

Ease of operation with minimum documentation

Facility to make better decision making through key information availability

Optimize working capital

Saving on finance costs by extending credit period

Not a borrowing but replacement of sundry creditor

Improved Vendor management

Lower administration cost for vendor financing, payments and settlements

Deployable solution & connected ecosystem

Digital onboarding of sellers, Export Factoring/Import Factoring, buyer and Insurance company.

Bidding process for each invoice. Transactional checks by platform. Payments currently as per existing mechanism.

Export Factoring/Import Factoring, undertake credit risk assessment and set up limits. Digital KYC, transaction-based DoA and NoA.

Export factor has an option to choose between an insurance company or import factor for buyer coverage as per own risk appetite.

Discover the source of value in your supply chain

Copyright © 2022 M1NXT. All Rights Reserved.